Articles

The newest Area doesn’t enable it to be an excellent deduction to have extra depreciation.DEYes. Bonus depreciation functions by basic to find qualified team property and then putting you to advantage to the service ahead of year-avoid. To take added bonus decline — or one depreciation — you should be using the resource. The new depreciation time clock initiate perhaps not when you buy the investment but after you put it in-service. So plug for the reason that espresso machine and keep the newest cappuccinos coming throughout every season.

- Administrative services, holiday accommodation and you will dining features, and you will elite group features would substantively make use of to make 100 % added bonus depreciation long lasting.

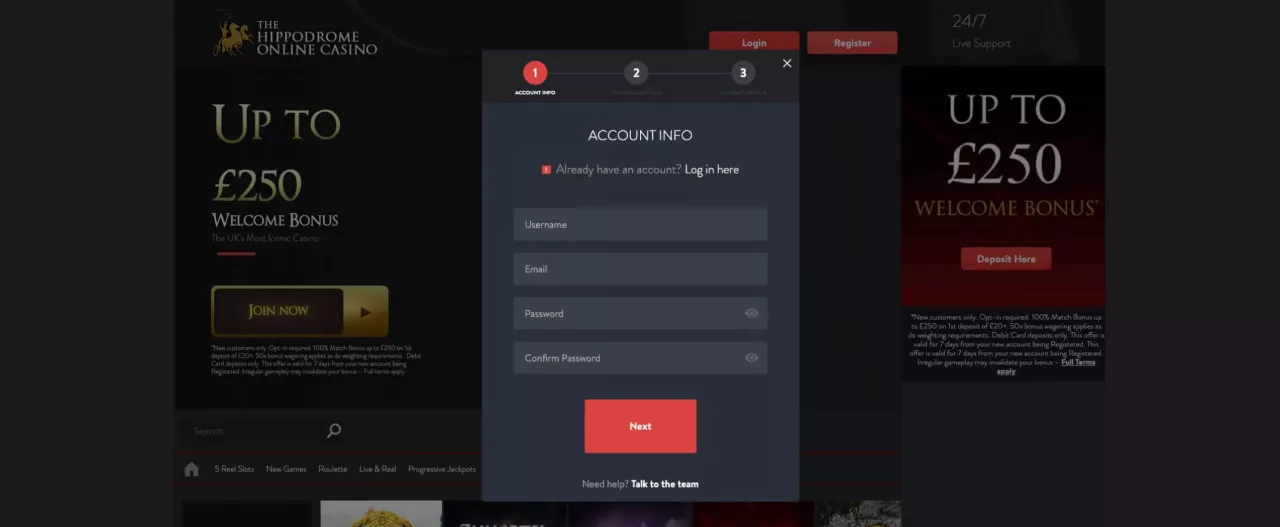

- Specific best British gambling enterprises we highly recommend is actually Mr Environmentally friendly and you can LeoVegas, you could discover far more advice within our dining table above.

- The alive broker gambling enterprise is actually running on various other gambling heavyweight, Advancement Playing.

- A few games try restricted about this offer, but you can effortlessly play such as titles as the Queens of Ra and Piggy Blitz for the free fund.

- Because of the discovering our detailed analysis, you can get to know more about per internet casino.

- Because the structures had been a huge show of the private money stock, improving the taxation therapy manage stop an enormous prejudice against funding regarding the taxation password.

In total, players within the Nj is rack right up more 2 hundred inside added bonus currency by simply joining the fresh account. Various other court gambling establishment says, attempt to be happy with smaller, but there are some great 100 percent free currency now offers available in Pennsylvania, Michigan, and you will Western Virginia too. If you live beyond these claims, you ought to is their hand in the sweepstakes gambling enterprises, some of which give no deposit incentives as well. Since there are not even of many court web based casinos from the You, the brand new no-deposit added bonus listing is also a bit brief.

Is 100percent Put Bonuses Simple to find?: 7 days the spanish armada casino

Generally speaking, Point 179 laws are much more versatile having timing than bonus depreciation legislation. Under Point 179, the brand new taxpayer is also decide to help save specific property for coming taxation holidays otherwise allege simply an element of the cost and delay additional part for another taxation season. That have added bonus depreciation, the level of depreciation allowable is strictly laid out. If the taxpayers choose it might be a lot more good for accept depreciation over the life of the new resource instead of playing with an expidited means, the brand new taxpayer is also choose not to deduct any special depreciation allowance.

Extra Decline

Corporate income taxA 7 days the spanish armada casino corporate taxation is levied because of the government and you can condition governments to the team earnings. A lot of companies are not susceptible to the brand new CIT because they are taxed while the ticket-due to companies, with money reportable within the individual tax. Section 179 of the income tax code allows businesses to subtract up to help you 100percent of the purchase price out of being qualified gadgets and you can/otherwise app listed in solution in the income tax year. Which supply is made to encourage businesses to purchase by themselves and is also good for smaller than average medium-sized organizations. Since the groups prepare to help you file government tax statements to own 2023 and you may look forward to 2024, it’s vital to understand the most recent laws and methods to increase taxation professionals. Less than previous legislation, you might use only incentive depreciation for new property.

The fresh Taxation Cuts and you will Work Work changed you to definitely rule, and from now on you need to use extra decline to own sales of new otherwise made use of property starting in 2018. Once you get individual assets for your business, including a car or computers, you to lasts for more than one seasons, you are required to subtract the purchase price a small immediately more ten years. This process is called “decline.” According to the possessions inside it, it will take anywhere from three to 39 decades to totally depreciate the expense of business assets. By-doing nothing, you’ll allege 80percent (60percent for 2024) bonus depreciation instantly to possess property you have listed in services inside the 2023 income tax 12 months.

However, there can be days in which such as an advantage is bound just to professionals remaining in a specific country, even when the gambling enterprise allows players away from numerous jurisdictions. This really is placed in the fresh fine print because the ‘United kingdom professionals only’, such. Professionals from the The newest Zealand, Canada, Norway, and Iceland gain access to their particular country-particular websites. The fresh local casino brings an appealing 100percent greeting extra and this varies dependent on the site utilized. Obviously, dedicated in order to the identity, it is worth considering its fulfilling jackpot slots.

Information Extra Decline

Limited Taxation RateThe limited tax speed is the quantity of more tax covered all the additional dollars gained since the income. The average income tax rate ‘s the overall tax paid back split up by the complete income made. A great 10 percent marginal taxation rates means that ten cents of the next dollars attained was removed because the taxation.

Hard rock Casino gives the best 100 percent free spins offer, that have to step one,100 considering thru a wheel twist abreast of join. Around 1,100 is found on provide, that gives you a large opportunity to appreciate freeplay. The new fifty is a wonderful treatment for attempt exactly what Lorsque Gambling enterprise now offers before you can put financing. It package may be used of all video game, as well as black-jack and you can roulette.

The newest TaxA income tax try a compulsory commission or fees collected from the regional, county, and you may national governing bodies from someone or enterprises to cover the can cost you away from general authorities features, merchandise, and you can issues. Although not, there’s a threshold to just how much qualified gadgets a business should buy whilst still being discover an excellent deduction. Qualified property does not include property otherwise real estate, including property. Inside the 2024, the benefit depreciation rates have a tendency to miss so you can 60percent, falling by the 20percent per year after that up until it is completely phased call at 2027 (just in case Congress doesn’t get it done to give they).